A contractor (Principal) pays a bond company (Surety) a premium and agrees to reimburse the bond company for any losses. In return, the bond company provides a guarantee to a Project Owner or another contractor (Obligee) on the contractor’s behalf. If the contractor does not perform, the Obligee can make a claim against the bond.

No. Performance Bonds cannot be cancelled once they are issued. Performance Bonds guarantee an underlying contract. Therefore, the contact must be completed, cancelled or terminated for the liability under the performance bond to cease. This is an important trait of performance bonds. Otherwise, there would be a strong incentive for a contractor to cancel the performance bond on a project that was having challenges. An exception to this rule is if the Obligee is willing to return all original performance bonds before the contract has started. You can read more about Performance Bond Cancellation here.

No. Performance bonds are underwritten by surety bond companies based on the financial strength and perceived ability of the principal and other indemnitors. Therefore, they will not transfer the obligation to other parties. The contractor may subcontract their obligation to others, but the principal and indemnitors are still responsible for the obligation until the contract is complete and any warranty or maintenance period has expired. This can be a significant consideration for contractors when selling their businesses.

A Performance Bond guarantees an underlying contract. A performance bond is not released like a letter of credit. Once the contract is complete and any warranty or maintenance period has passed, the performance bond’s obligation is finished. There is no need to get the performance bond back from the Obligee or “close it out.” Generally, the surety bond company will send Contract Status Report requests to the Obligee to know when the contract has been completed and when the maintenance period has started.

Small bonds under $1,000,000 can be approved and issued in a matter of minutes for those Principals with good credit. Click here or the button to the right to apply.

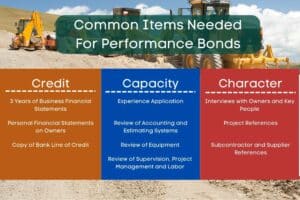

For larger performance bonds or bond programs, we need to collect underwriting information including:

Once we receive this information, we can typically have a Performance Bond Program or approval set up within 24 hours. More difficult circumstances may require longer lead times. For example, a contractor utilizing the SBA Bond Guarantee Program should expect a few days for approval.

In the United States, Performance Bonds can only be written by licensed property and casualty insurance agents. Although many insurance agents can sell surety products, most do not have the expertise or proper surety bond company access to do so. Agents then must be appointed with licensed surety bond companies.

Unfortunately, fraud exists in performance bonds. Customers should verify that they are getting a surety bond that is highly rated by a service such as A.M. Best. For many contracts and all U.S. Federal Government contract, the performance bond company needs to be listed in the U.S. Treasury Circular 570. This is often referred to a “T-Listing”. Avoid buying “Individual Surety” Performance Bonds. These are performance bonds that are not backed by a Corporate Surety Bond Company. Although they are allowed on certain Federal projects, they are often fraudulent. Because of rampant fraud, individual surety bonds rarely satisfy the bond requirements of non-government contracts.

Performance Bonds are original, legal documents. Instead of processing performance bonds directly, many surety bond companies give approved bond brokers the authority to sign on surety’s behalf. This is referred to as a Power of Attorney. For the performance bond to be valid, it needs to be signed by an individual listed on the surety bond company’s Power of Attorney and the surety bond company’s seal must be on the performance bond. A valid seal is often looks like a notary stamp.

The answer is Yes as long as a surety bond company has given the broker permission to use an electronic seal. However, the Obligee must still accept an electronic seal. Many Obligees have adopted practices allowing these electronic seals, but some still require a “wet seal” from the broker.

The SBA has a program for Performance Bonds. However, the SBA is not a direct writer of Performance Bonds. Instead, the SBA provides incentives for surety bond companies to write bonds for contractors that may not otherwise qualify. The SBA does this by providing reimbursement to surety bond companies if they suffer a loss on an approved account. These reimbursement guarantees range from 80%-90% of each Performance Bond written, depending on the status of the contractor. In return the SBA collects a fee for this guarantee which is currently 0.6% of the contract price. Learn more about the SBA Surety Bond Guarantee Program here.

Typically, yes if the bankruptcy is completed and discharged. A contractor that has filed a recent bankruptcy may have to use the SBA Surety Bond Guarantee Program discussed above and/or use other surety bond assistance such as funds control or collateral. The contractor should also expect to pay a higher performance bond cost. You can read more about obtaining performance bonds with bankruptcies and credit challenges here.

No. Performance bonds are not insurance. Although they are often written by insurance companies and insurance agents, performance bonds are very different from insurance. A Performance Bond closely resembles a credit product and underwriting assumes that the surety bond company will not suffer a loss. Unlike insurance, performance bonds always require indemnity. This means that if the surety bond company suffers a loss, they will seek reimbursement from the contractor and indemnitors.

On the other hand, insurance is written with the expectation of losses. The insured is only responsible for a portion of the loss through deductibles and coinsurance. You can read more about the differences between Surety Bonds and Insurance here.

Most surety bond companies require personal indemnity from all shareholders with more than 15% ownership. This means that the owner or owners put their personal assets at risk in return for receiving the bond. Since surety is essentially a credit product, they expect the owner(s) to stand behind the company personally. However, some surety bond companies will agree to waive personal indemnity for contractors with strong balance sheets and good experience. The requirement for these waivers varies by surety bond company. You can read more about personal indemnity here.

This is common in credit relationships. If there was a performance bond claim, a surety bond company does not want to argue over which assets belong to the owner and which belong to their spouse. This is also a means of ensuring that corporate assets are not shielded by transferring them to the spouse. Surety Bond companies are very reluctant to provide a waiver of spousal indemnity if the other spouse is signing. They may be willing to exclude certain assets in writing, if it makes sense. You can read more about indemnity here.

There are a couple of alternatives to performance bonds. These include Letters of Credit and Subcontractor Default Insurance, or SDI.

Performance Bonds are typically unsecured credit. Most surety bond companies do not file liens against assets unless the contractor is in a claim situation. Also, surety bond companies must investigate performance bond claims. The bond company must be careful to pay only valid claims, or they may risk their right to be reimbursed.

On the other hand, letters of credit are typically secured by hard assets and receivables. They are also usually “irrevocable”, meaning that once committed, there is very little protection for the person or company posting the letter. You can read more about the advantages and disadvantages of surety bonds versus bank lines of credit here.

Subcontractor Default Insurance or SDI can be a great product to reduce subcontractor default risk. Unfortunately, SDI does not replace performance bonds. First, SDI protects the General Contractor. It does not directly benefit the project owner. Therefore, it cannot be used on public work protected by The Miller Act or Little Miller Acts.

Secondly, SDI does not protect subcontractors and suppliers. Technically, a performance bond does not either. However, performance bonds are typically written with payments bonds. The payment bond provides the protection to these parties. Read more about Performance Bonds and SDI here.

Typically, to get premium for a performance bond refunded, you need to return the original bond to the surety bond company. Performance bond premium cannot be refunded with copies of the bond because they are non-cancellable. Also, the performance bonds must be returned before the project starts. This prevents adverse selection. Otherwise, an owner could return a bond once the project is almost complete, or when they are sure there will be no issues.

Performance Bonds guarantee a contract, and these bonds are invoiced based on the amount of the underlying contract. In many cases, the contract amount changes throughout the life of the project. An increase in the contract amount will lead to an overrun. This means the surety bond company is entitled to additional premium because of the additional size and risk. Conversely, a project decrease would result in an underrun. This means the surety bond company owes you a refund of some of the bond premium because the project was smaller, and they had less risk.

A Performance Bond guarantees that an obligation will be completed according to the contract. A Payment Bond guarantees that subcontractors and suppliers will be paid on the project and therefore be free of mechanic’s liens. Another way to say this is that a performance bond guarantees that a project will be completed for an agreed amount. On the other hand, a payment bond guarantees that the bills will be paid.

A Performance Bond can be written by itself but is often written together with a payment bond. There is no additional charge when the two surety bonds are written together. Together these two bonds provide valuable protection for a construction project. Read more about the differences between these two bonds here.

Yes. There are many different companies that write performance bonds. Each company has their own underwriting appetite. Some companies prefer net worth, while some prefer working capital. Some concentrate on Fortune 500 companies, while some look for small and mid-sized businesses. Also, different surety bond companies have different financial strengths which determines their ability to write performance bonds. Having a variety of surety bond companies writing performance bonds is a good thing for contractors. It ensures there are solutions for all types of situations.

The U.S. Federal Government maintains a list of surety bond companies who they approve of doing business with. This list is the Treasury Department’s 570 Circular. This is sometimes referred to as a “T-Listing”. The list also gives the largest performance bond amount each surety bond company can write to the Federal Government. Often, surety bond companies have agreements with re-insurers or other surety bond companies if the project is larger than their Treasury Listing. You can check your company’s T-Listing here.

Surety Bond Capacity refers to the total surety bond credit that a surety bond company extends to the Contractor (Principal). Although many factors are considered, typically surety bond capacity is a multiple of analyzed working capital and/or net worth. Surety bond capacity can be both “bonded” and “total”. Bonded is the total value of bonded contracts a surety bond company will support. Total is the most work a surety company will support for a principal, regardless of whether the work is bonded or unbonded.

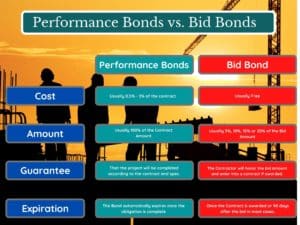

Although these are both types of Contract Surety Bonds, they are not the same thing. A Bid Bond guarantees that a Contractor will enter a contract at the bid price. It is a tool to protect the bid letting.

Performance Bonds guarantee the completion of a project after the principal has bid or negotiated it. A Performance Bond is commonly issued after using a bid bond on a project. However, a bid bond is not required to issue a performance bond. You can read more about Bid Bonds here. Contractors often need both types of bonds.

Performance bonds are a type of surety bond. They are classified as Contract Surety Bonds because they guarantee the performance of a contract. They are most commonly used in construction contracts but can be used by other industries.

Surety Bonds are a broader category of guarantees and include Contract Bonds, Commercial Bonds and Fidelity Bonds. Learn more about surety bonds here.

Although they sound similar, performance bonds are not performance guarantees. Performance guarantees are a promise to meet certain levels of output or savings. These guarantees can take a variety of forms but are common in the energy and manufacturing industries. Performance guarantees may promise a certain level of energy output or savings. They can also guarantee that equipment will perform to certain standards.

Bond underwriters do not want to be responsible for performance guarantees and it will be difficult to write performance bonds for contracts with performance guarantees. Generally, the performance guarantee must be separated from the contract covered by the performance bond. Some specialty insurance carriers will write insurance policies to cover performance guarantees.

Axcess Surety is the premier provider of surety bonds nationally. We work individuals and businesses across the country to provide the best surety bond programs at the best price.