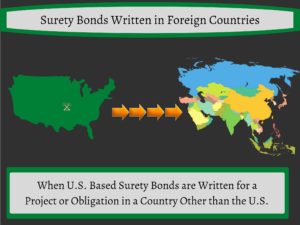

International Surety Bonds are a broad category that refers to a Surety Bond written in a foreign jurisdiction. This article is written from a perspective that a Principal is based in the United States.

For a United States based company a Surety bond needed in another country is an international Surety bond. For example, a Chicago, Illinois based contractor needing a performance Bond for a project in Paris, France. These bonds are very difficult to write and usually only the strongest companies qualify for these bonds.

Foreign laws are a huge challenge for writing international Surety bonds. Each country has their own unique sets of laws and case laws for how they have been interpreted. Case law for Surety in the U.S. is very old. Bond companies have a good indication of how their indemnity agreements and Surety laws will be interpreted.

This is not the case in foreign countries. Surety Bond companies risk being unable to recover for their losers or being able to enforce their contractual rights. This may deter Surety companies from writing bonds in foreign countries unless they have prior experience with that country.

Just as Surety bond companies may not have risk in a foreign country, a Principal may not either. Traveling is risky for many businesses but especially in construction. Managing an unknown labor source, different climates, supply chains and local laws all add risk.

Usually Surety bond companies are only willing to write these bonds for large companies who have international experience or have a significant net worth capable of absorbing problems and setbacks.

As mentioned above, labor is a big consideration for bonding international projects. Will a company use their own labor or hire local labor and subcontractors? Both have risks.

Bringing their own staff provides more certainty on cost but the company must adequately estimate lodging costs and security costs. There is also a risk that the company will be unable to work with local stakeholders and meet local standards.

Hiring local workers also has risks. The company may be unable to get labor to show up or get the production it desires.

Mobilization and Supply Chain may be one of the most underestimated risks. Getting equipment and supplies to other countries can be expensive and time consuming. Returning that equipment home or disposing of it may also be a challenge.

Further, in many countries, a company cannot simply go down the street and purchase supplies or parts for broken machinery. Getting these parts and supplies may take weeks or months which could idle a project. Companies should plan on these risks upfront and have contingency plans in place.

Local politics are a major underwriting consideration and one that is difficult to quantify. Both Principals and Surety Bond underwriters need to understand this risk as much as possible, however, in hopes of avoiding problems.

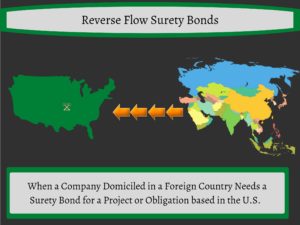

Reverse Flow refers to Surety written in the United States for Obligees that are domiciled in another country. An example would be a Performance Bond for a project in Chicago, Illinois written for a Contractor based in London, England. Although not easy, reverse Flow Surety bonds are easier to write than Surety bonds written in foreign countries.

All Surety bonds require indemnity and international Surety is no different. This means the Surety bond company expects to be reimbursed for any losses by the Principal and any other indemnitors.

Indemnity is the biggest challenge in reverse Flow Surety bonds. The Principal is located in a foreign country with different contract laws and legal systems. There is a higher risk that a U.S. based Surety company may not be able to enforce their indemnity agreement or they may have to spend considerable resources doing so.

Countries where the Surety bond company has established indemnity agreements in place will give them more comfort on writing these bonds. U.S. Surety companies are increasingly setting up offices with local underwriters and expertise. Having these underwriters’ familiarity with both the Principal and local laws, helps get these international bonds written.

When Considering Reverse Flow Surety Bond, having a local office in the U.S. However, this is only really a benefit if the local office has and maintains a strong balance sheet, produces financial statements and has staff beyond just salespeople.

If the local office has a strong assets base, one way to get approval for Surety bonds may be to have the company sign a capital retention agreement. A capital retention agreement is an agreement between the Principal and the Surety Bond Company where the Principal agrees not to decrease capital in the Principal company below a certain level.

In the case of International Surety, a capital retention agreement would require the local U.S. operation to maintain a certain level of capital in the local company and not transfer it to the parent company overseas. This provides comfort to the Bond company that they have resources that can reimburse them if a claim occurs.

If a company does not have a U.S. operation, the Surety bond company may require the Principal to post collateral. Usually, this collateral requirement is in the form of an Irrevocable Letter of Credit at a U.S. based lender. Collateral may also be required regardless of local operations to reduce the risk to the Surety.

International Surety Bonds can refer to a lot of different Surety bonds. These include:

Contract Bonds as the name suggests, guarantee the performance of a contract.

Bid Bonds guarantee that a contractor will enter into a contract for the bid price if selected as low and/or most responsible bidder. Bid bonds also serve as a form of pre-qualification. By providing a bid bond, an Obligee is assured that the bidding Principal has been pre-qualified from a third-party corporate Surety company.

Bid Bonds are very important in International Bonding. Performance and Payment Bonds can be a challenge to get on international projects. Without Bid Bonds on these projects, anyone could bid projects without knowing if they can get the final project bonds. This could waste time and money for the project owner.

Performance Bonds guarantee the completion of a contract. Performance Bonds are important for international Surety bonds as they ensure that a contract will either be completed or there will be capital available from a bond company to help complete the obligation.

Payment Bonds

Payment Bonds provide protection to labor and material suppliers. Payment Bonds can be important in International Surety by giving labor and suppliers confidence that they will get paid. Without these assurances, many may choose not to participate in a contract for a foreign country.

Supply Bonds guarantee that a product or service will be delivered for an agreed upon price. Supply Bonds differ from performance bonds in the fact that all the Principal is doing is delivering a product or service.

That is not to say that supply bonds are without risk. Supply bonds are a very important and very common type of international Surety bond. Supply bonds may be needed for both unique and common products. The more unique the product, the more risk to a Surety bond company guaranteeing the delivery, however.

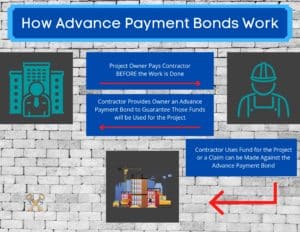

In the U.S. it is common practice for a contractor to perform the work before the contractor can be paid for material or labor. This forces the contractor to effectively finance a portion of the project.

However, in many other countries the contractor is paid in advance for labor and/or materials. This allows them to purchase material and labor for the project. In return, the contractor provides an Advance Payment Bond. These bonds guarantee that the funds given to the contractor will be used for the project and not diverted somewhere else.

Advance Payment Bonds are essentially forfeiture bonds which makes them risky. However, because they are so common, Surety bond companies have become very comfortable writing these bonds in many countries.

License and Permit Bonds are required to do business in many countries, States and municipalities. They are a very common requirement when doing business in the U.S. License and Permit Bonds simply guarantee that a company or individual(s) will comply with local laws and ordinances. These bonds are very easy to obtain.

Customs Bonds are required by the U.S. for importers of goods. There are several types of customs bonds, but the most common ones guarantee that all goods are in compliance with U.S. laws and that all taxes, duties and fees will be paid. Lots of U.S. Surety bond companies write customs Bonds and these are obtainable for most companies.

Financial Guarantee Bonds are very common in international Surety. Financial Guarantee Bonds generally require that the Principal perform or forfeit the entire bond amount. For this reason, Financial Guarantee Bonds are also referred to as Forfeiture Bonds. These bonds are highly risky for the Surety bond company and usually require collateral for even the strongest Principals.

For all the reasons mentioned in this article, international Surety bonds are usually reserved for large, financially sound companies with lots of experience. In many cases, a company will need seven to eight figure net worth to even qualify.

A company will also likely need audited financial statements and an established lender relationship.

For companies new to international bonding, time will be needed to set up a bond or bond line. Underwriters will need time to underwrite all the risks and create indemnity agreements for the foreign country if necessary. This could take a few weeks so companies should be prepared.

Collateral in the form of an ILOC is often required for smaller companies when international Surety bonds are needed. This collateral usually needs to be in the form of an ILOC with a lender in the country that the bond is needed.

Companies should also read what the contract is asking for. In many countries a contract may say Surety bond when an ILOC is what is really required. You can read more about Surety bonds compared to letters of credit here.

We are seeing more Surety bond companies get involved in International surety. More competition should create more competition and comfort with these risks over time. That should eventually make it easier for smaller companies to obtain international bonds. In the meantime, many of these risks will require collateral. Contact Axcess Surety anytime to obtain international bonds.

Axcess Surety is the premier provider of surety bonds nationally. We work individuals and businesses across the country to provide the best surety bond programs at the best price.