Get An Instant Quote on a Southern California Edison Utility Deposit Bond Now

A Utility Deposit Bond, or Utility Bond is a type of surety bond that protects a supplier of utility services from non-payment by the person or entity using those services. These utility suppliers are often water, gas, or electric companies providing these services to homes and businesses. Similar to security deposits, utility deposits serve as a form of financial guarantee for the utility company in case the business defaults on their payments. The purpose of this deposit is to prevent any interruptions in the supply of gas, electricity, or water to businesses. You can read more about Utility Bonds here.

Southern California Edison Utility Bonds may be required to hook up utility service for some applicants. It is also common to require utility bonds when an applicant has a history of late or non-payments, or credit issues.

Southern California Edison Utility Deposit Bonds guarantee that a customer will pay their utility bills to Southern California Edison. The bond guarantees that the bond purchaser (the Principal) will pay Southern California Edison (the Obligee) for all service rendered. If the principal does not pay their bill, a claim can be filed against the third-party company writing the bond (the Surety). The surety may then seek reimbursement from the principal.

The bond also guarantees that the surety bond company will pay damages and expenses to Edison in relation to collecting payment. The bond gives the surety bond company 30 days to pay Edison after the surety receives notice that the principal has defaulted.

An Edison Utility Deposit Bond usually costs about 2% of the required bond amount for each year that the utility bond is in place. For example, a $10,000 bond would cost $200 annually. This cost can be more for those with credit challenges.

Generally, yes. We work with surety bond companies that write utility bonds for individuals and businesses in all circumstances. Even those with credit challenges can usually obtain these bonds. Contact one of our experts today if you are concerned about your credit history.

Southern California Edison Utility Bonds can be purchased online in a matter of minutes. Smaller bonds to not require a credit check. Simple information on the applicant is all that is required. Larger bonds may require a personal credit check of the applicant, but they can still be purchased online.

Yes. The bond form gives requires 30 days written notice. The notice is effective 30 days from the postmark date of which cancellation is mailed to Edison. The principal and bond company are usually still responsible for claims that occur during the 30 days before cancellation is effective. Cancellations should be sent to:

Southern California Edison

300 N Lone Hill Avenue

San Dimas, CA 91773

Southern Edison requires that a utility bond company be written by a surety bond company that is rate A- or better by A.M. Best. The bond company must also be listed on the U.S. Treasury’s Circular 570. This can eliminate a number of bond companies so customers will want to check the financial rating.

Southern California Edison Utility Bonds are not insurance. The company or person requesting the bond will be required to sign an indemnity agreement. That means they agree to reimburse the bond company for any loss, which is quite different than insurance. You can learn more about the differences between the two products here.

Do not delay in getting your utility services set up. Southern Edison Utility Bonds are easy to obtain for most people. The experts at Axcess Surety can help even those with credit challenges get these bonds. For most they can be purchased online in minutes. Contact us today.

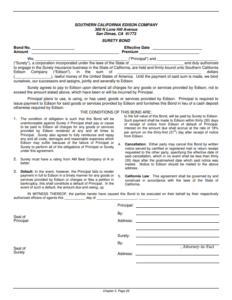

Southern California Edison Bond Form:

You can obtain a free copy of the Southern California Edison Utility Bond Form by clicking on the image.

Axcess Surety is the premier provider of surety bonds nationally. We work individuals and businesses across the country to provide the best surety bond programs at the best price.