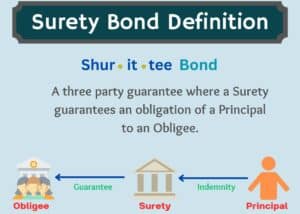

A Surety Bond is a three-party guarantee between a Principal, Obligee and Surety, whereby the Surety guarantees an obligation for the Principal to the Obligee.

Surety Bonds generally fall into 3 broad categories which include Contract Bonds, Commercial Bonds, and Fidelity Bonds.

Contract Bonds guarantee a contractual obligation and are common in construction contracts. However, they also include many service contractors such as bus companies, janitorial services, IT companies, security services companies, printers and many other businesses. These bonds include Bid Bonds, Performance Bonds, Payment Bonds and Maintenance Bonds. Some sureties also include Subdivision Bonds and Site Improvement Bonds in this category. Contract Bonds generally guarantee that the Principal will complete a contract and pay subcontractors and vendors for their services and supplies.

Commercial Bonds are the second broad category of surety bonds. There are many subcategories of commercial surety bonds including License and Permit Bonds, Notary Bonds, Court Bonds, and Miscellaneous Bonds. Many professional organizations such as mortgage brokers, contractors, dealerships, and manufacturers require commercial surety bonds to obtain and maintain a license. Additionally, public officials, attorneys and property managers often need commercial surety bonds as well.

Fidelity Bonds are another category of surety bonds. Fidelity Bonds protect against theft and crime. These surety bonds include Erisa Bonds, Financial Institution Bonds and Employee Dishonesty Bonds.

A Principal is the person needing the bonds. This can be an individual or a company. The principal provides underwriting information, bond premium and an agreement to indemnify to the Surety. In return, the Surety provides the principal with a surety bond that they can give to the third-party obligee that backs up a promise or guarantee from the principal to the obligee. Should the Principal default on their obligation, the obligee can make a claim to the Surety to compensate them for the principal’s default.

The Surety Bonds is valued by the obligee because Corporate Sureties must have very strong liquid balance sheets. This makes getting compensated faster and easier than having to go after a principal for payment.

Indemnity is key to surety bonds and it is important to understand the key parties that will be asked to indemnify. The Principal will always be an indemnitor on a surety bond. This is either the company or individual listed on the surety bond.

Third-Party Indemnitors - Third-party indemnitors are other individuals or companies that provide indemnity on behalf of the principal. This is very similar to co-signing a loan. This is a tool to help someone get a surety bond, it is uncommon.

Obtaining Surety Bonds depends on the type of bond. Many commercial bonds can be purchased online with very little information. Our state surety bond page makes it easy to search, purchase and print these bonds.

However, contract bonds, and larger, more complicated surety bonds often require additional underwriting. Generally, in these cases, the Principal applying for the surety bond must submit financial and other supporting information to the surety for approval. Other documents may include an application, bank reports, and qualification materials. Those needing contract bonds can read more about the process known as the 3Cs here.

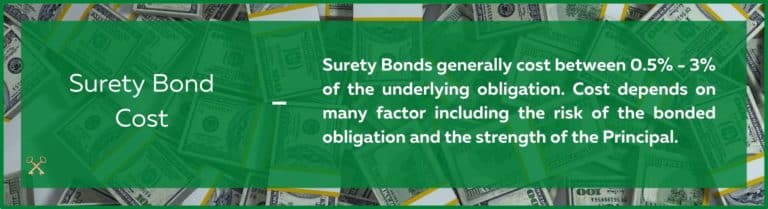

Surety Bonds can cost as little as 0.2% for Principals with very large net worths, and as much as 10% for Principals with credit challenges. The cost of the surety bond depends on the type of obligation being guaranteed and the financial strength of the Principal. The general pricing for some common surety bonds is below. However, prices can vary, and principals with credit challenges should expect to pay more.

Contract Surety Bonds - Most contract surety bonds cost between 0.5% - 3% of the contract amount. More can be read about how contract bonds are priced.

License and Permit Bonds - Generally, 1% - 2% annually.

Court Bonds - Generally, 1% - 3%

Freight Broker Bonds - Generally, $1,000 - $3,000 annually.

Notary Bonds - Generally, $10 - $100 for each commission period.

Surety Bonds protect the public. They provide a strong incentive for Principals to perform their duties and fulfill their obligations. Because surety bond companies seek indemnity, a default can mean financial ruin for the Principal.

If a Principal does default, the surety has the financial means to compensate the obligee. This is especially important when public money is involved. Consider performance and payment surety bonds. If a contractor defaulted on a public project, it may cost taxpayers significantly more to get the project completed by another contractor. Additionally, subcontractors and material suppliers may not get paid for the work they have done and have to file bankruptcy. Surety bonds protect all those parties by providing financial resources when things go wrong.

Surety Bonds always required indemnity. That means that the company, individual, or both agree to reimburse the surety bond company if a loss occurs. In this way, surety bonds closely resemble a credit product.

This can cause confusion as surety bonds are often written by companies and brokers who write insurance. In fact, a broker must have a property/casualty insurance license to sell surety bonds. However, surety is very different from insurance in many ways including the following:

More can be read about the differences between the two products by clicking the image.

In some cases, companies and individuals may choose other alternatives to surety bonds. These normally include an Irrevocable Letter or Credit (ILOC), or cash. Although these can be good options, they do tie up resources that could be used for other purposes. Additionally, surety bonds are often comparable or cheaper when factoring in costs and opportunity costs such as a return on cash. More can be read about the differences between surety and ILOCs or cash by clicking the images below.

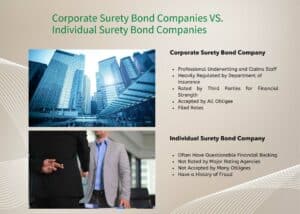

There are many different companies that write surety bonds. Two main categories are Corporate Surety Companies and Individual Surety Companies.

Corporate Surety Bond Companies are professional businesses that are licensed to provide surety bonds. Corporate Surety Bond Companies are heavily regulated to make sure they have the resources to pay claims. They are generally licensed and governed by each state’s Department of Insurance. Corporate Surety Bond Companies are also rated by credit agencies such as A.M. Best, Fitch, or other. These ratings provide a measurement of a surety’s financial strength and ability to pay obligations that come due.

Corporate Surety Bond Companies that want to provide surety bonds to The Federal Government must also be listed in the U.S. Treasury’s 570 Circular. This document is also known as a “Treasury Listing”, or “T-Listing” for short. The T-Listing is the maximum amount of a single surety bond that can be issued to The Federal Government for that surety bond company.

Corporate Surety Bond Companies are generally members of the Surety and Fidelity Associations of America (SFAA). SFAA tracks the written premium and losses for these companies on a quarterly and annual basis. There are currently more than 100 different Corporate Surety Bond Companies tracked by the SFAA.

Individual Surety Bond Companies are businesses or people that use their own assets as backing for a surety bond. Individual Surety Bond Companies are generally not rated by reputable third-party companies and the assets used to pay claims may be suspect. Individual Surety Bond Companies have a long history of fraud. Surety Bonds issued by these companies are allowed on some Federal Projects, but the government has taken steps to prevent fraud when these surety bonds are used.

Private Contracts and most other public obligations do not accept surety bonds from Individual Surety Companies. Companies and individuals purchasing surety bonds should check the requirements and whether the surety bond company meets those requirements.

A surety bond should be typed on an accepted bond form. For contract bonds, many companies offer standardized bond forms such as AIA, ConsensusDocs and AGC. Many surety bond companies, contractors and owners also have their own manuscript bond forms.

For license and permit bonds, many states, municipalities and The Federal Government have bond forms that must be used. In instances where an obligee does not have their own bond form, they will generally accept a form that the surety bond company uses.

All surety bonds should be stamped with a seal from the surety bond company writing the bond. Historically, these seals were raised seals that were manually crimped onto the surety bond. However, modern surety bonds may also use an electronic seal and still be valid. It is important that the seal used on the surety bond matches one of the seals on the power of attorney included with the bond.

A Surety Bond Company seal generally looks similar to the image below.

Every surety bond should be accompanied by a Power of Attorney. A Power of Attorney (POA) is a document in the surety bond company’s name showing which people are appointed to sign a bond on behalf of the company. The POA should be signed by the bond company.

The POA also gives a maximum dollar amount of a surety bond that can be issued by the appointed agents for a particular surety bond company. In most cases, the power of attorney is “unlimited” meaning that it is not capped at a particular amount. However, some surety bond companies will put both single and aggregate limits on the power of attorney for those appointed agents and brokers.

Lastly a power of attorney should show which seals are acceptable to be accompanied with the POA. The seal on the surety bond should match one of the seals on the POA.

It is crucial that all surety bonds be signed by both the principal, and somebody appointed by the surety bond company on the power of attorney. These signatures may be either original signatures, or electronic signatures if the obligation and obligee allow it. Some bond forms require a witness signature as well.

Generally surety bonds are obtainable even with bad credit or other credit blemishes. In instances where an individual or company has strong financial resources, and a history of success, it may be very easy to obtain a Surety bond.

In other situations, it may require the use of a specialty surety bond company or the use of Surety tools such as The SBA Surety Bond Guarantee Program, funds control, and/or collateral.

Generally, the most difficult situations involve tax liens. The U.S. Government will take priority over other creditors so tax liens will usually need to be paid or full collateral will likely be required to get a Surety bond.

Surety prequalification letters are used to show if a principal is qualified to perform an obligation and if they can provide adequate bond limits. Prequal letters are very common in construction. These letters usually show the surety bond company, the principal's bond capacity and other useful information. Learn more about Surety Prequalification Letters.

An All Rights Letter is used when a project has already begun, and a surety bond is needed. The letter is signed by the obligee saying that there are no known issues with the contract, including payment issues. These letters assure the bond company that there are no claims pending before issuing a surety bond.

Surety has been around a long time. In fact, the first recorded evidence of surety goes back to 2750 B.C. However, the code was formalized around the time of Hammurabi. Modern suretyship dates to about 1845 when corporate sureties started writing fidelity policies. The reason this is important to the modern reader is that surety is an old and tried profession. It has been at the center of much litigation and case law over the years. That has led modern surety rules and regulations to be well established and tried. Surety Bonds continue to be an ever-evolving field, however. An excellent history can be found at Cornell for readers interested in more information on the beginnings and history of surety.

Surety Bonds can be complicated and misunderstood. The following are common errors and misspellings that occur for people looking for surety bonds.

While the intent is the same, these are all incorrect ways or terms for Surety Bonds. Some are misspelled, and others are just incorrect. For example, surety bonds are not a "loan". They are also not "insurance" as discussed above.

This depends on the type of bond. Most court bonds including probate bonds cannot be canceled until they are released by the court.

Contract Bonds are also not cancellable. They are in place until the underlying obligation has been fulfilled.

Most types of commercial Surety bonds can be canceled. However there is usually a notice requirement to the Obligee.

Generally, the answer is yes. Most surety bond companies take into account the owner(s) personal assets when deciding to write a surety bond. For companies, owners with 15% or more ownership in the company stock will generally be asked to sign personally for the bond.

There are exceptions. Companies with very strong net worth positions may be able to get surety bonds with only the company's indemnity. However, not every surety bond company will consider this. It is usually limited to companies with over $1 million in analyzed net worth.

Electronic Surety Bonds are valid as long as they are issued by a licensed Surety bond company and bond broker. These electronic bonds still need to be sealed with the Surety bond company's seal. They must also include a power of attorney and be signed by an individual listed on the power of attorney.

Many obligations require that a surety bond is rated "A-" or better. This is a rating of the bond company's financial strength. This is an indication of the surety bond company's ability to pay their obligations. A very popular rating service is A.M. Best.

Surety bonds that can be canceled can usually have the unearned portion of the guarantee refunded. This is not always the case as some obligations are fully earned once the bond is written.

Other surety bonds such as contract bonds cannot be refunded because they are non-cancellable. If a principal can get the contract bonds returned from the obligee before the project starts, then they may be refundable.

If an individual is required to personally indemnify the surety bond company, their spouse will be required to sign as well. This prevents couples from transferring or sheltering assets. A surety bond company may be willing to exclude some assets if they are of sentimental value only, or if a spouse owns another business that is not tied to the indemnity package.

Most corporate surety bond companies own multiple companies with separate Treasury Listings. They can combine company limits by attaching multiples seals and powers of attorney to the bond.

Most surety bond companies also have agreements with reinsurance companies or other bond companies for when larger bonds are needed. They simply use the other company's paper and T-Listing to issue the bond or combine it with their own.

Generally, no. A surety bond is considered unsecured credit because they do not make a UCC filing against the principal’s assets unless a claim occurs. That said there is an indemnity agreement in place that requires the principal to make the surety bond company whole for any loss.

There are instances when collateral may be required for surety bonds. These are generally when either the principal cannot qualify without it, or when the bond is guaranteeing a difficult obligation.

Usually applying for a surety bond will not affect your credit. Most surety bond companies do a "soft credit pull". However, this can vary by bond company. Please check with us first if this is a concern.

This depends on the type of surety bond. Most premium finance companies will finance surety bonds that can be canceled if a customer does not pay them. Most premium finance companies will not finance surety bonds that cannot be canceled such as contract bonds.

The principal on the bond is always responsible for the payment of bond premium. However, most contractors include the cost of surety bonds in their bids to the obligee. Further, many companies pay or reimburse their employees for the cost of professional surety bonds such as license bonds.

Many obligations require that a surety bond is rated "A-" or better. This is a rating of the bond company's financial strength. This is an indication of the surety bond company's ability to pay their obligations. A very popular rating service is A.M. Best.

Bonded and Insured is a term that has generally been applied to crime coverage. It was used to mean that a potential customer was protect from loss by crime, theft or damage by a company. Today, this coverage is either provided via crime insurance or fidelity bonds.

Dividends are not common in surety. However, some states such as Texas do have dividend plans. In Texas, contractors are eligible for a dividend once their bonded project concludes without any claims. The amount of the dividend varies by bond company.

It depends on the type of surety bond. Many license and permit bonds can be purchased online in only a few minutes. Credit based surety bonds generally take less than a couple of hours. However, large bond programs, complicated bonds or bonds for principals with credit challenges can take longer.

Axcess Surety is the premier provider of surety bonds nationally. We work individuals and businesses across the country to provide the best surety bond programs at the best price.